House value. Very homeowners will pay anywhere between $300 so you’re able to $500 for a home appraisal, however is entitled to a house check waiver (PIW) when they generate a beneficial 20% down payment otherwise has extreme security. The PIW choice is unique in order to Fannie mae financing: Government-backed purchase money (FHA, Va and you may USDA) require domestic appraisals it doesn’t matter how much you add down.

Identity. Federal national mortgage association advice require lender to review the fresh property’s label history and ensure its free of any earlier in the day ownership says regarding early in the day people otherwise one judgments or liens, eg delinquent possessions taxes. Name insurance policy is needed to protection the mortgage amount to the purchase otherwise refinance of any Federal national mortgage association loan.

Property versions. Old-fashioned loan criteria enables you to funds a home with upwards in order to five gadgets within the a regular subdivision, good co-op, condominium strengthening or a well planned tool development (PUD). Federal national mortgage association has the benefit of a created home loan system having are designed property connected with a long-term base.

Occupancy products. You should use a fannie mae financing to invest in a primary or secondary house, or a residential property. At exactly the same time, government-supported finance was simply for primary belongings simply, more often than not. You to definitely caveat: New down-payment standards is actually high to possess next property (10% minimum) and capital attributes (20% minimum).

Financial insurance. A huge advantageous asset of conventional mortgage loans is because they don’t need mortgage insurance policies which have a good 20% advance payment, if you’re loans supported by the latest Government Houses Government (FHA) need it no matter downpayment. Conventional mortgage insurance policies, entitled PMI (individual home loan insurance), generally can cost you ranging from $29 and you can $70 each $one hundred,100000 you obtain, which can be reduced inside your payment per month.

Ideas on how to get a fannie mae home loan

Of numerous conventional lenders render Fannie mae financing points. Check around which have at the least less than six lenders to collect quotes, preferably for a passing fancy go out. Request a rate secure after you’ve located a home loan bring one suits you and you will funds.

Fannie Mae’s HomeReady system allows you to fool around with recognized advance payment direction (DPA) currency when you find yourself reduced toward bucks getting a deposit. Pose a question to your lender whenever they provide the DPA program you might be interested inside.

Fannie mae direction if you cannot pay for your mortgage repayments

When the difficult monetary times strike, lenders need pursue Fannie mae guidelines to help you come across solutions to stop property foreclosure. Federal national mortgage association offers programs getting consumers which owe more than their property is definitely worth, also known as underwater mortgages. Choices vary from:

Financing changes. For folks who fall behind on costs or sense an abrupt loss otherwise shed inside income, you could get a mortgage amendment. Your loan servicer will work to you to build a preliminary-name or long lasting service, eg reducing your price, extending their label or decreasing the equilibrium your debt to make your mortgage more affordable.

Forbearance. A home loan forbearance permits you temporarily prevent and make payments and you will discuss exactly how if in case possible compensate for skipped payments. There are several an effective way to repay the paused payment. Federal national mortgage association forbearance payment recommendations allow you to:

- Give new payment months over to go out which have highest monthly payments

- Range from the unpaid equilibrium for the end of one’s mortgage

- Spend the money for entire equilibrium for the a lump sum if you have this new resources

Under water re-finance software. In the event the house is value less than your loan balance and you have a fannie mae financing, you will be capable reduce your fee with an effective HARP substitute for mortgage. In some instances, an appraisal is not expected and you will not require normally economic documents to help you be considered.

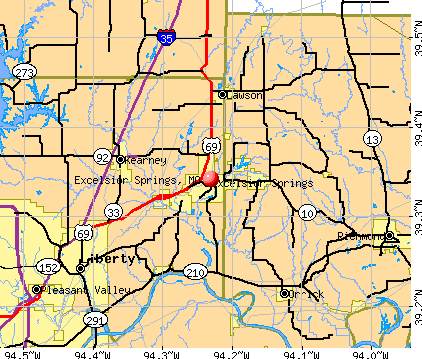

Loan limitations. The fresh new Government Houses Funds Service (FHFA) set http://cashadvanceamerica.net/500-dollar-payday-loan/ conforming mortgage limits each year predicated on changes in mediocre home prices. Since 2022, maximum compliant traditional limitation is actually $647,two hundred to possess an individual-home for the majority parts of the country. Higher limitations, named high-equilibrium fund, can be found in highest-rates regions of the nation. Restrictions are also high when you are to acquire a two- in order to four-tool household.