Overview

Capital One offers a number of the higher interest rates of every deals factors we review. As well as, you can confidence keeping those individuals returns due to the fact lender will not fees account fix costs.

Which have complete-service twigs during the seven says along with Washington, D.C., Capital One also offers a physical exposure, together with good online equipment and you can app sense. The business has recently brought Capital You to definitely Cafes in huge places into the 7 claims across the country, incorporating other chance for deal with-to-deal with connections.

In addition to their Money One to 360 Results Bank account, Financial support You to also offers 9 certificate of put (CD) membership, one of other products.

If you are looking getting a spot to park your money one to earns decent interest in addition to helps it be very accessible in case you need dollars getting an urgent situation otherwise an advance payment, it’s worth considering the numerous savings possibilities Capital One to brings.

Financing That Bank Evaluation

Money You’re one of the most identifiable banking brands maybe not only on the You.S., in Canada therefore the U.K., also. Creating as the a company based into the 1988, the company is continuing to grow so you’re able to a fortune five-hundred business providing an effective selection of banking, purchasing and you may borrowing solutions and much more. it even offers many individual finance training attributes and you may materials.

The firm claims a handy and you may rewarding sense towards buyers it caters to. With its wide array of economic choices, it will certainly getting convenient to you if you’re looking so you can keep your entire levels in one place. Such as for instance, you could open a capital That charge card and you will a money One to IRA, putting on the ease at the office with just that facilities. Plus, possible create any and all profile from the going online, contacting or going to certainly one of their of several real twigs.

- Savings & MMA

- CD’s

Investment You to Checking account Has

And additionally its almost every other financial products, Resource You to offers a number of different kinds of offers membership. They might be a classic bank account and various Cd account. The business also provides among the better APYs connected to for every checking account. Plus, you might prevent account repair costs once you unlock certainly one of this type of deals profile.

Financing You to brings FDIC (Government Deposit Insurance Enterprise) cover on your deposits to the fresh judge count. Most savings account sizes perform provide several options when it comes from what type of account we wish to open. It means you might unlock a merchant account possibly once the a single account, a joint account, a combined account that have a small or a full time income faith account.

Financing One to 360 On the web Coupons Membership

With respect to your own first discounts account, Resource That offers the 360 Abilities Family savings together with Kids Family savings. The 360 Abilities Bank account even offers a 2.25% APY with interest compounded month-to-month. There is no minimum count you have to deposit initially, neither can there be the absolute minimum count you have got to look after within this the new membership. Your finances will earn interest regardless of how much cash is into the.

You can find a couple charges that you could see with a great 360 Results Coupons Accountpleting an outbound domestic cord transfer tend to ask you for, since the will a duplicate from an announcement generated over the last 24 months. You ount regarding outgoing deals. Youre limited by half dozen outbound purchases by federal laws.

And work out in initial deposit into the 360 Efficiency Family savings, you’ve got a few options. You can even deposit finance over the telephone, online, mailing a, an electronic digital finance import otherwise a residential cord transfer. It is possible to deposit cash. How long amongst the put and its particular supply will vary with regards to the sorts of deposit, you could usually predict the funds immediately after five months.

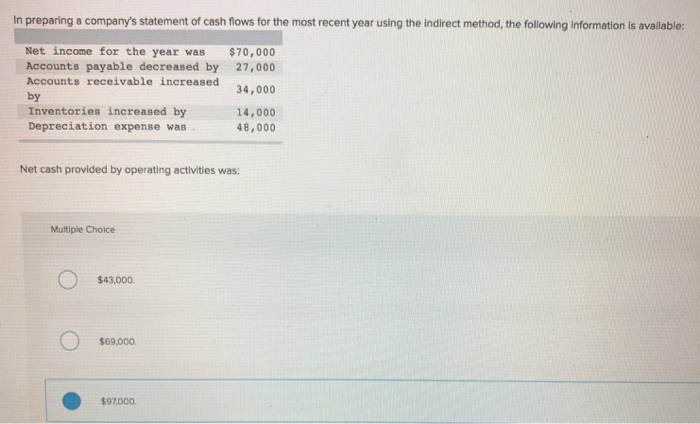

Withdrawing funds from your own 360 Overall performance Family savings is as simple as calling support service or going on the internet. You can not withdraw more what is in your account during the date. Then there are observe your own withdrawals due to the fact youre limited to six outgoing transactions for every declaration years. Groing through that restrict can be in the a punishment payment. When you find yourself not knowing exactly how many transactions you’ve made, it is possible to head to your online account and you can control your account(s) into its account page (such as for instance shown a lot more than).

The main city You to Children Checking account allows you to deposit currency into the a make up your son or daughter to coach him or her regarding the preserving and you can paying. This membership along with comes with no repair costs or equilibrium/deposit minimums, which will surely help put on display your man you to definitely discounts has no to be expensive. The only real percentage listed in the fresh new membership disclosure is actually for good content of your own statement. The children Checking account keeps good 0.30% APY, so your children’s coupons shall be besides embroidered, instance your personal. The fresh new procedure off deposit and withdrawing currency are identical once the the latest 360 Performance Savings account.

Each other profile also offer usage of Resource A person’s Automatic Savings Bundle. This choice allows you to set their deals account configurations and you may then return so you can autopilot. The membership will perform https://availableloan.net/loans/direct-express-emergency-cash/ all the growing and all work. It is an ideal program particularly for the children Bank account, and that means you and your kid can watch the cash build rather than much worry. On the simple a web site and a mobile software, you could potentially replace your configurations anytime. With respect to coverage, one another levels are also FDIC-insured up to the fresh court count.

You have several different options in terms of discounts membership control. Having both membership, you might unlock it one account, a shared account otherwise just like the a living believe membership. There are further rules nearby beginning a joint membership and a living faith account. Factors to consider you realize your own agreement records to know just what exactly is entailed. Regarding the children Family savings, you may want to unlock it a shared membership with a minor. This means you to small and another adult one another own new coupons account.